Contents:

For example, if the stock’s price were to jump to $50 you could still exercise the option to buy it at $10 per share before the option expires. The higher the price, in this example, the more intrinsic value the option has. Again, put options give you the right to sell an asset at a predetermined price on or before a preset expiration date. A put option is in the money when the underlying security’s price is lower than the strike price, thus implying intrinsic value.

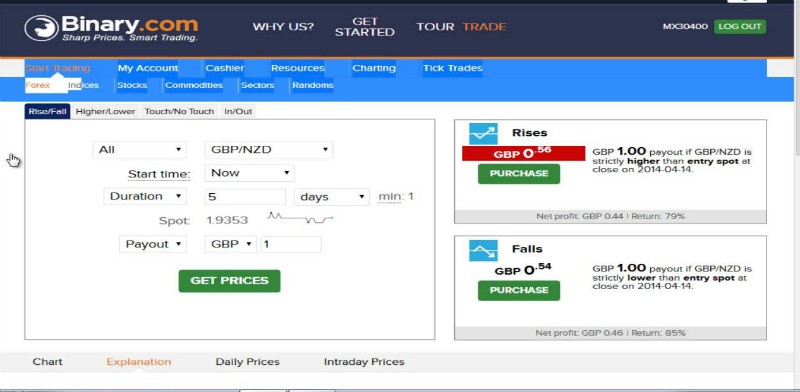

If you were to https://forexarena.net/ a put option that’s out of the money, you’d be selling it for less than its current value. Whether you’re trading call or put options, the size of the gap between the underlying asset’s value and the strike price is what determines intrinsic value and whether you’re in the money. The key is having your guess about whether a stock’s price will rise or fall in a particular time frame pay off. This gives them the right to buy 100 shares of the stock before the option expires. The total cost of the option is $50 (100 shares times $0.50), plus a trade commission.

Make this request if you currently have a TPA and want to change your TPA destination to an alternate investment company. Complete this transaction to establish or change Annuity and Cash payments to a foreign currency. Rollover funds from your Investment Solutions IRA contracts to another IRA at TIAA or to an IRA at another investment company. Account information and transit number of bank where we’ll send your payments.

Step 2.2: Create an Express account

From your account Dashboard, you can view an account and its balance. As we learn more about your account, Stripe might be able to decrease your settlement timing automatically. Stripe notifies you in the Dashboard and through email when the microdeposits have arrived in your account.

- SPY rallied to $210 a share just three weeks after the VIX spiked.

- Because ITM options have intrinsic value and are priced higher than OTM options in the same chain, and can be immediately exercised.

- They paid $0.50 for the option, but the option only has $0.25 of value now, resulting in a loss of $0.25 ($0.50 – $0.25).

- This is why they are forbidden to directly fund the government, say, by buying treasury bonds, but instead fund private economic activity that the government merely taxes.

Using your savings account for infrequent expenses, such as a medical emergency or that much-needed vacation, isn’t usually problematic. Let’s look at a few ways to access the funds in your savings account. Clicking this link takes you outside the TD Ameritrade website to a web site controlled by third-party, a separate but affiliated company. TD Ameritrade is not responsible for the content or services this website.

Unclaimed Money from the Government

A put option is OTM if the underlying stock price is above the strike price. “In the money” and “out of the money” are phrases that describe when an option has positive or negative intrinsic value, respectively. In other words, they’re used when the strike price of an option and the market price for a security are different. So when the strike price is below the stock’s price in the market, you are able to buy the stock at a price lower than what you would have paid if you bought it on the stock exchange. This signifies that the option has some intrinsic value, and you would likely exercise the option. If you, for example, own a call option on a stock, that option is in the money when the strike price is below the stock’s market price.

You can use the concept of in the money and out of the money to manage your risk. The more time there is before an option expires, the higher its time value will be. That’s because there’s more time during which the underlying security’s price can change, causing the option to go from out of the money to in the money. Where S is the spot price of the underlying, K is the strike price, τ is the time to expiry, r is the risk-free rate, and σ is the implied volatility.

How to Find Unclaimed Money

In general, in-the-money https://trading-market.org/s are viewed as a less risky proposition for buyers and a riskier proposition for sellers compared to out-of-the-money options. The terms “in the money” and “out of the money” really describe whether an option has intrinsic value. A call option gives you the right but not the obligation to buy the underlying security, while a put option gives you the right, but not the obligation, to sell the underlying security.

Eat Out And Help Avon Police Raise Money For Special Olympics – Patch

Eat Out And Help Avon Police Raise Money For Special Olympics.

Posted: Thu, 02 Mar 2023 16:27:29 GMT [source]

For example, a put option will be in the money if the strike price of the option is greater than the Forward Reference Rate. Now, assume you have a put option at $10 and the underlying stock is trading for $12 a share. Again, you’re out of the money because if you exercised the option you’d sell for less than what the stock is trading for on the open market. And the higher the price goes, the further you go out of the money. The strike price is the price at which an option can be exercised, i.e. bought or sold.

Which required banks to maintain sufficient reserves for operation and make a clear distinction between savings accounts and checking accounts. Regulation D was relaxed by lawmakers in 2020 to make access to savings easier, though some financial institutions may maintain similar monthly limits. Use this guide to learn how to add funds to your account balance and transfer the funds into your users’ bank accounts, without processing payments through Stripe. This guide uses an example of a Q&A product that pays its writers a portion of the advertising revenue that their answers generate. At-the-money refers to any option, put or call, whose underlying asset market price is exactly the same as the strike price. Options traders also will term an option «around the money» when the underlying asset price is close to an option’s strike price.

- Make this request if you currently have a TPA and want to change your TPA destination to an alternate investment company.

- Therefore, if an option is OTM, the trader will need to sell it prior to expiration in order to recoup any extrinsic value that is possibly remaining.

- That option could end up being worth more than the trader paid for the option, even though it is currently out of the money.

- An at-the-money option has no intrinsic value, only time value.

- These terms are used to define or measure an option’s intrinsic value at any given time.

- In practice, for low interest rates and short tenors, spot versus forward makes little difference.

According to the Treasury, Congress has either raised, extended or revised the definition of the debt limit 78 times since 1960, and it hasn’t yet failed to act on the debt limit when necessary. Still, economists at Goldman Sachs on Monday warned the debt limit debacle this year could be the worst since the 2011 crisis that triggered a market correction. But how does that relate to American economics since there is no «cashing out» procedure. If the government gave everyone a bunch more money, there is no «checks and balances» since no one, at the end of the day, goes to the cashier station and exchanges their «chips» for something of value. A lot of people out there are asking «why can’t we just print more money and solve the poverty problem?» Terms like «inflation» and the «devaluing of the dollar» are the usual buzz answers to that question. (simple supply/demand economics) But this is where I’m curious.

At the money is a situation where an option’s strike price is identical to the price of the underlying security. An ATM option is one in which the strike price and price of the underlying are equal or very close to equal. Whether you bank with Huntington or not, there are options to cash your money order.

Moneyness

Past performance of a security or strategy does not guarantee future results or success. But for contrarian traders, that’s just when they say opportunity comes a-knocking. You can also manage your communication preferences by updating your account at anytime. AARP is a nonprofit, nonpartisan organization that empowers people to choose how they live as they age.

Most people use this expression when speaking of two similar products, in which one has a higher perceived quality than the other. Anther way this idiom can be used is in the case of two legal forms of currency that are recognized to have the same value by a government. If one of these two forms is considered to be higher value by the general public, the “higher” value currency will be hoarded, and only the “lower” value currency will be circulated. By using this site or/and our services, you consent to the Processing of your Personal Data as described in our Privacy Policy. If you don’t agree with our Privacy Policy then you shouldn’t use our services. Improve your vocabulary with English Vocabulary in Use from Cambridge.

Students Raise Money for Janitor Forced Out of Retirement – FOX News Radio

Students Raise Money for Janitor Forced Out of Retirement.

Posted: Thu, 02 Mar 2023 15:23:20 GMT [source]

Being out of the https://forexaggregator.com/ doesn’t mean a trader can’t make a profit on that option. A trader could have bought a far out of the money option, but now that option is moving closer to being in the money . That option could end up being worth more than the trader paid for the option, even though it is currently out of the money. Therefore, if an option is OTM, the trader will need to sell it prior to expiration in order to recoup any extrinsic value that is possibly remaining. For current account holders only, Huntington provides money order cashing services at no additional charge.